ONSbank

Contents

Author: Het Instituut

After an exploratory process, performed by Het Instituut and No-Academy, the ONSbank activation programme is being developed by Het instituut and the Kandidatenmarkt. The latter is an organisation in Amsterdam West that helps young job seekers find employment or an internship by coaching and training them in presentation and networking techniques.

The ONSbank proposal was selected as one of the finalists for the Dutch Design Awards in the research category. Describing the project, the jury wrote: "The result of the study offers a solution for a global problem; it is more than a statement directed at the banking world. The concept creates awareness of the current problematic nature of borrowing money, which affects almost everybody. In this new system of borrowing, alternative methods are used to repay loans. This opens up a new perspective on borrowing."

Debt is traditionally seen as an individual problem, where somebody is sanctioned for not paying back a loan, a mortgage, the instalments of a purchase, interest, taxes or fines. Once your income is lower than your debts and the resulting fines are added to it, you're caught in a catch 22 situation: you are obliged to do the impossible, and punished for not succeeding.

The description of the situation in financial/legal terms is logical and simple: you are legally and financially required to pay what you owe. A simple graph in two dimensions. In the ONSbank project the same situation is taken as a four-dimensional phenomenon because, well, real life is lived, as we all know, in four dimensions.

First, problematic debt obviously has a financial and legal dimension. Asking about the chain of events that led to the situation in which somebody lost grip of his or her life and spiralled down into debt reveals a social dimension.

Second, when somebody runs into misfortune or commits a blunder and loses grip, these well-known factors weigh in: class, education, family situation and cultural and ethnic issues.

Third, there is the aspect of personal development, as there are often also psychological reasons for somebody to end up in severe debt. Depression, trauma, divorce, addictions or a troubled self-image often play a decisive role. This third dimension is crucial to the ONSbank project as it relates to the emotional, mental and intellectual capacity to get out of debt and successfully stay out of it.

Fourth, there is the element of time, the process to be more precise, and the possibility to structure the process of change that enables young people to leave debt behind and regain some grip over their lives and develop a sense of a meaningful future for themselves. This fourth dimension brings all the previous three together in a designed process, a trajectory that has financial/legal, social, personal and, in a general sense of the word, political dimensions.

ONSbank is a project from Het Instituut in collaboration with No-Academy, De Kandidatenmarkt, Streetcornerwork, Rabobank, Stichting DOEN, Instituut GAK, Het Amsterdams Fonds voor de Kunst (AFK) and Fonds 21.

Links

CONTRIBUTE

Feel free to contribute to Beyond Social.

Author: Het Instituut

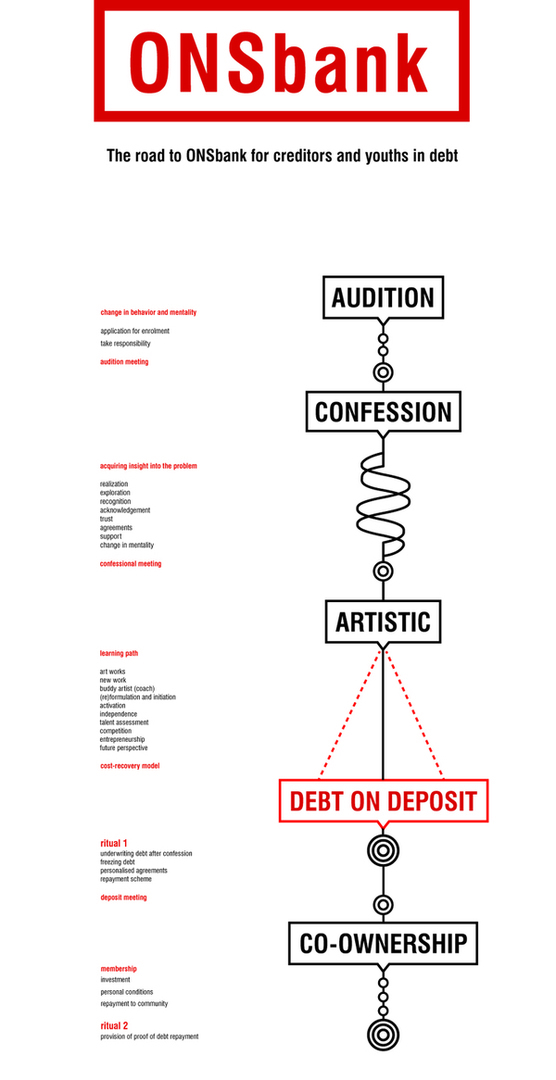

ONSbank is a unique type of cooperative bank which helps young people clear their debts and get their lives on a positive financial track. It's a combination of an alternative business model and an activation programme in which confession, reflection and action help change the behaviour and mentality that led to the creation of the debt in the first place. To become a client of this bank you first have to successfully complete a compulsory programme and find new work together with an artist.

After an exploratory process, performed by Het Instituut and No-Academy, the ONSbank activation programme is being developed by Het instituut and the Kandidatenmarkt. The latter is an organisation in Amsterdam West that helps young job seekers find employment or an internship by coaching and training them in presentation and networking techniques.

The ONSbank proposal was selected as one of the finalists for the Dutch Design Awards in the research category. Describing the project, the jury wrote: "The result of the study offers a solution for a global problem; it is more than a statement directed at the banking world. The concept creates awareness of the current problematic nature of borrowing money, which affects almost everybody. In this new system of borrowing, alternative methods are used to repay loans. This opens up a new perspective on borrowing."

Debt is traditionally seen as an individual problem, where somebody is sanctioned for not paying back a loan, a mortgage, the instalments of a purchase, interest, taxes or fines. Once your income is lower than your debts and the resulting fines are added to it, you're caught in a catch 22 situation: you are obliged to do the impossible, and punished for not succeeding.

The description of the situation in financial/legal terms is logical and simple: you are legally and financially required to pay what you owe. A simple graph in two dimensions. In the ONSbank project the same situation is taken as a four-dimensional phenomenon because, well, real life is lived, as we all know, in four dimensions.

First, problematic debt obviously has a financial and legal dimension. Asking about the chain of events that led to the situation in which somebody lost grip of his or her life and spiralled down into debt reveals a social dimension.

Second, when somebody runs into misfortune or commits a blunder and loses grip, these well-known factors weigh in: class, education, family situation and cultural and ethnic issues.

Third, there is the aspect of personal development, as there are often also psychological reasons for somebody to end up in severe debt. Depression, trauma, divorce, addictions or a troubled self-image often play a decisive role. This third dimension is crucial to the ONSbank project as it relates to the emotional, mental and intellectual capacity to get out of debt and successfully stay out of it.

Fourth, there is the element of time, the process to be more precise, and the possibility to structure the process of change that enables young people to leave debt behind and regain some grip over their lives and develop a sense of a meaningful future for themselves. This fourth dimension brings all the previous three together in a designed process, a trajectory that has financial/legal, social, personal and, in a general sense of the word, political dimensions.

ONSbank is a project from Het Instituut in collaboration with No-Academy, De Kandidatenmarkt, Streetcornerwork, Rabobank, Stichting DOEN, Instituut GAK, Het Amsterdams Fonds voor de Kunst (AFK) and Fonds 21.